Avoid 2 Popular Consumer Stocks as Inflation Persists

By Chad Stone, Banyan Hill Publishing, Monday, January 15

After two weeks of flat trading across major stock market indexes in 2024, one thing is clear…

We’re still worried about inflation.

Data for December came in hotter than expected, with the Consumer Price Index (CPI) rising 0.3% to 3.4% for the month. Core CPI, which excludes volatile food and energy prices, did fall in line with what economists expected.

For comparison, CPI was at 6.5% in December 2022!

The Federal Reserve’s efforts to tamp down inflation seem to be working. But we’re not out of the woods yet.

That means bracing for more volatility ahead…

The great news is that we have a system in Green Zone Power Ratings. It helps us find stocks that are well-suited for this environment. It also gives a clear indication of stocks to avoid if higher prices stick around for longer.

And with the American consumer at the core of every inflation debate, I thought I’d stick to some consumer-related stocks in today’s Stock Power Daily.

Let’s see what Adam O’Dell’s proprietary Green Zone Power Ratings system says…

The Home Improvement Boom … and Fizzle

My wife and I are working on our townhome … slowly.

We were fortunate to buy during the peak of the pandemic in the summer of 2020, scrounging up just enough cash to secure a 30-year mortgage.

What we didn’t plan for was the rush of bored do-it-yourselfers who were stuck at home due to COVID-19 lockdown protocols. While we were getting settled in and unpacked, they were storming our local Lowe’s and Home Depots, buying up every last brushed bronze showerhead in South Florida.

By the time we were settled in and ready to tackle our first big project, prices for materials had blown through the roof!

Maybe you were in the same boat (email me your own pandemic home improvement horror stories to Feedback@MoneyandMarkets.com).

To put some numbers to the trend, Home Depot’s trailing 12-month revenue was $110 billion on January 31, 2020. That number jumped to $132 billion in January 2021, and then again to $151 billion in 2022! Revenue growth peaked at $157 billion in January 2023 and has been slowly trending lower again.

Why the history lesson?

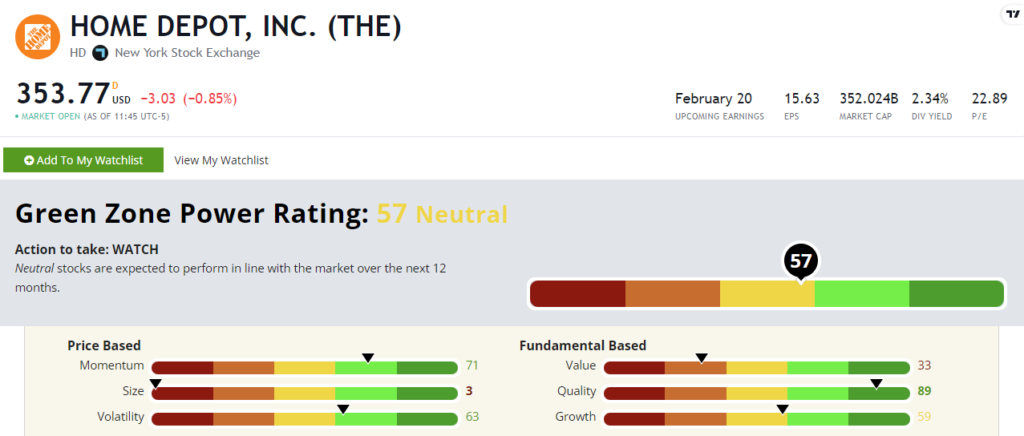

Because Green Zone Power Ratings says Home Depot Inc. (NYSE: HD) isn’t on pace to crush the market again in 2024.

Home Depot stock rates a “Neutral” 57 out of 100 in Adam’s system. Neutral stocks are set to perform in line with the broader market over the next 12 months. If the market rises 5% in 2024, HD stock should do roughly the same.

With an 89 rating on Quality, it’s clear that Home Depot is using that flood of new revenue to shore up its business.

The stock also has strong Momentum at 71 out of 100 after gaining 28% since its October low.

But you can see that weaker growth playing out in HD’s ratings. After revenue peaked last January, lower revenue dragged its Growth rating down to 59.

All of this tells me to keep an eye on Home Depot stock — but I’m not buying yet.

The “New” Way to Pay

Buy now, pay later isn’t a new concept. Neanderthals were likely loaning out their best rocks to hunters if it meant they’d get paid later with the freshest meat.

And who doesn’t love the idea? Get the thing you want, as long as you promise to pay for it in small chunks over some set amount of time.

Almost one-third of Americans said they were considering buy now, pay later loans in December 2023, according to a LendingTree survey.

With higher prices and stagnant wage growth, more consumers may turn to buy now, pay later as a way to fund certain purchases.

With that as a backdrop, let’s see how one of the biggest names in this space looks in Green Zone Power Ratings.

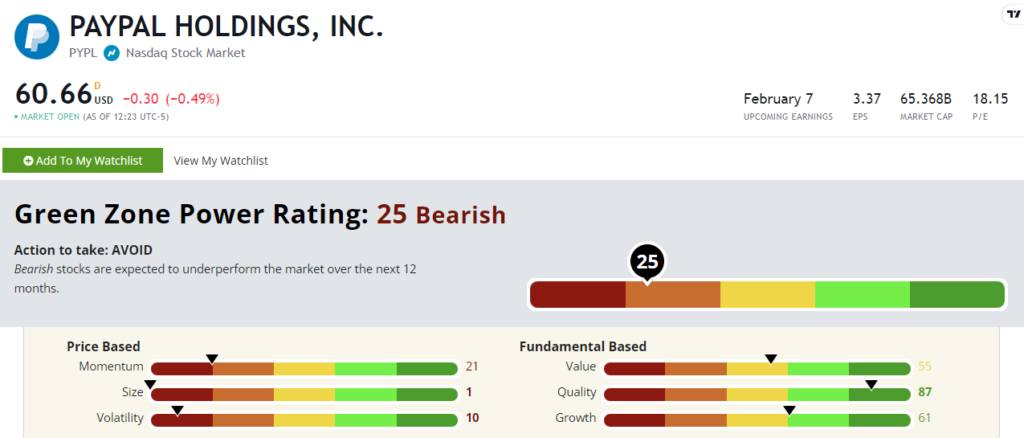

PayPal Holdings Inc. (Nasdaq: PYPL) rates a “Bearish” 25 out of 100 in Adam’s system. Bearish stocks are set to underperform over the next 12 months.

On the fundamental side, PYPL is solid. Its Value is middle of the road, but sports solid ratings on Quality and Growth.

What’s worrisome is PayPal’s price-based metrics. It rates a 21 or lower on Momentum, Size AND Volatility.

Over the last year, PYPL’s share price has declined more than 22%, all while the broader S&P 500 gained almost 20%.

This doesn’t spell doom for PayPal. It’s a solid business based on fundamentals.

But if you’re looking to capitalize on consumers turning to buy now, pay later platforms in 2024, Green Zone Power Ratings says to look elsewhere.

7 Best Dividends to Buy and Hold Forever [sponsor]

Have you ever passed over a company and later regretted not buying it? MarketBeat has identified 7 stocks that appear to be nothing special at first glance, but have truly incredible long-term prospects. These companies print billions of dollars in cash each year, yet many investors are ignoring them. Find out what the market is missing with MarketBeat's free report 7 Stocks to Buy & Hold Forever.