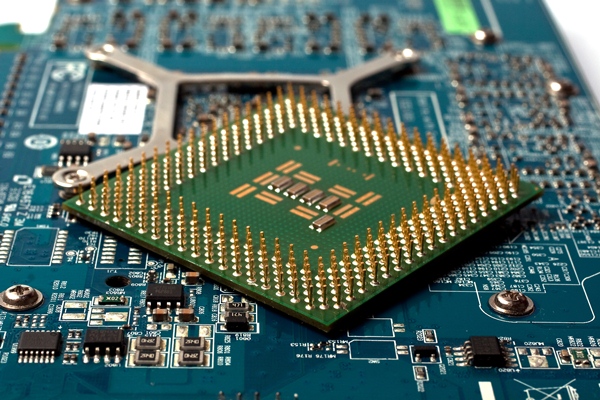

AMD Stock Price Up After Raising Guidance on Revenue Growth Expectations for 2020

By Ian Cooper, Investors Alley, Saturday, August 1

Advanced Micro Devices (AMD) exploded on Wednesday after announcing it expects for 2020 revenue to grow about 32% from 2019 to roughly $8.88 billion.

That’s a respectable increase from initial guidance of $8.08 billion AMD had provided previously. Analysts were only looking for AMD 2020 revenue guidance of about $8.4 billion. AMD also earned an adjusted 18 cents on sales of $1.93 billion in its latest quarter. Analysts were only looking for 16 cents on sales of $1.86 billion.

“We delivered strong second quarter results, led by record notebook and server processor sales as Ryzen and EPYC revenue more than doubled from a year ago,” said Dr. Lisa Su, AMD president and CEO. “Despite some macroeconomic uncertainty, we are raising our full-year revenue outlook as we enter our next phase of growth driven by the acceleration of our business in multiple markets.”

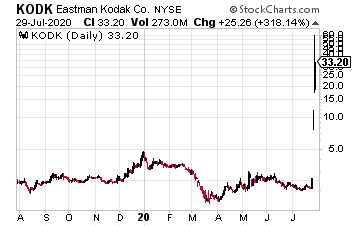

Eastman Kodak (KODK) soared more than 200% this week after President Trump announced that, “Our 33rd use of the Defense Production Act will mobilize Kodak to make generic, active pharmaceutical ingredients.” In addition, “Kodak said Tuesday it will produce pharmaceutical components that have been identified as essential but have lapsed into chronic national shortage, as defined by the Food and Drug Administration,” says CNBC.

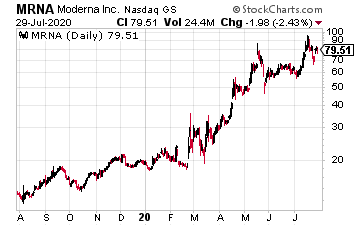

Moderna Inc. (MRNA) is racing higher again, tacking on $1.70 on news it just entered into a Phase 3 human trial for a COVID-19 vaccine. Over the weekend, the company announced an additional round of funding from Biomedical Advanced Research and Development Authority (BARDA), a department under the U.S. Health and Human Services Department (HHS).

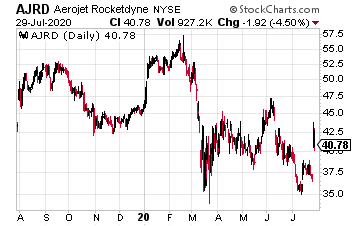

Aerojet Rocketdyne Holdings Inc. (AJRD) was up more than 17%, or $6.19 on the day after posting earnings. “Q2 2020 was a great quarter for Aerojet Rocketdyne,” said Eileen Drake, CEO and President of Aerojet Rocketdyne Holdings, Inc.

“Sales in the quarter were up 6% year over year primarily driven by growth in defense programs, including GMLRS and MRBM. Margins in the quarter were a solid 14.9%, reflecting a continued focus on strong program performance.” In addition, the company said, “Backlog has once again reached an all-time high – $6.8 billion at quarter end. Included in our backlog was the NASA contract modification award received in May to produce an additional 18 RS-25 engines in support of deep space exploration missions. Free cash flow of $131.5 million was excellent in the quarter, bringing year-to-date free cash generation to $111.4 million compared with $24.3 million in the first six months of 2019.”

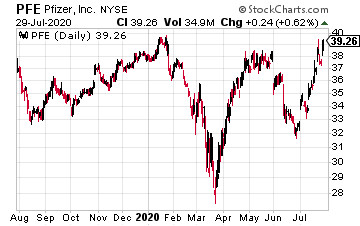

Pfizer (PFE) was up more than $1.50 on the week on anticipation of a potential vaccine, and on earnings news and a better than expected outlook. According to CNBC, “he company reported adjusted earnings of 78 cents per share during the three months ended June 30, higher than the 66 cents per share projected by analysts surveyed by Refinitiv. Revenue fell 11% to $11.8 billion from $13.26 billion during the same quarter last year, but Wall Street saw it as good news since it was more than the $11.5 billion analysts expected.”

The company also raised its full-year outlook expecting to earn $2.85 to $2.95 a share from a previous forecast of $2.82 to $2.92. It also expects to post revenue of $48.6 billion to $50.6 billion, which is up from previous guidance of $48.5 billion to $50.5 billion.

The #1 stock to turn $25k into tens of thousands of dollars for life [sponsor]

I've identified a stock that will be your cash register for the next 30 years. But don't just buy shares to claim your income. Do this one thing with this one stock. Click here for the details.