3 Dividend Stocks That Continue to Reward Investors

By Tim Plaehn, Investors Alley, Friday, May 1

It seems to be every day that I read a press release or two announcing a dividend reduction. The COVID-19 triggered shutdown of the economy has a lot of companies looking to conserve cash. One way to keep money in a company is to cut or suspend dividend payments. While the dividend reduction may be necessary for the business to survive, any cut is not good news for investors.

The government policy forced shutdown has resulted in dividend changes from companies that, before the COVID-19 outbreak, no one would have considered as candidates to slash their dividends. Here are three companies that have already announced substantial reductions in their payouts.

Few companies have faced more challenges in the past than has The Boeing Company (BA). In 2019 it was the grounding of the 737 Max jets. Before it announced the suspension of the dividend on March 20, Boeing shares were yielding 6%, and the dividend had increased for eight straight years.

Before suspending its dividend on March 19, Ford Motor Company (F) had paid a $0.15 quarterly dividend since the start of 2016. Ford had paid a steady dividend since 2012. In recent years Ford had been priced to yield 5% to 7%, making the stock popular with income-focused investors.

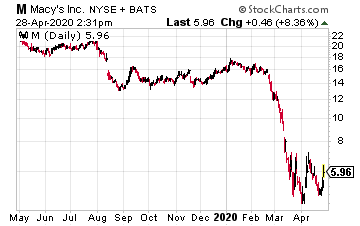

The economic shutdown has taken Macy’s (M) from a consistent, dividend-paying company to one on the verge of bankruptcy. Before the crisis, Macy’s shares were priced to yield 8% to 9%. The dividend was suspended on March 20. Macy’s shares are another former, higher yield stock that no longer pays dividends.

On the other end of the dividend, cutting companies are those that stay committed to paying dividends to investors, despite any slowdowns in their business operations. While it is hard to predict how long the COVID-19 challenges to business will last, here are three companies that remain committed to paying dividends and now sport very high yields.

Enterprise Products Partners L.P. (EPD) is an energy midstream services company that has grown its dividend rate for 21 consecutive years.

The company has announced the dividend to be paid in May at the same rate as the previous payout. The shares went ex-dividend on April 29, but there’s strong indication that future dividends will continue to be paid.

EPD currently yields 10.6%.

Historically, the yield has been 5% to 6%.

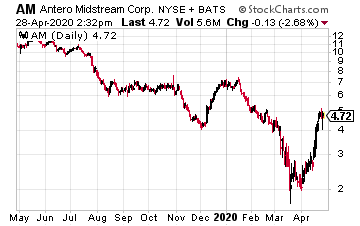

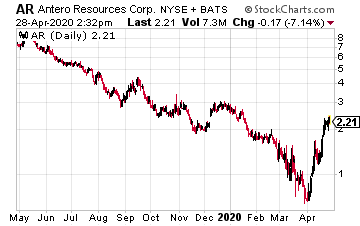

Antero Midstream Corp. (AM) provides natural gas gathering, processing, and transport services in the Marcellus Play.

The majority of AM’s revenues derive from contracts with upstream producer Antero Resources (AR), which has committed to high single-digit production growth in 2020.

Antero Midstream surprised the market by announcing an unchanged dividend to be paid in May.

The fact that the dividend was not cut now, in the middle of the crisis, points to continued payment of the quarterly dividend.

AM currently yields 24%.

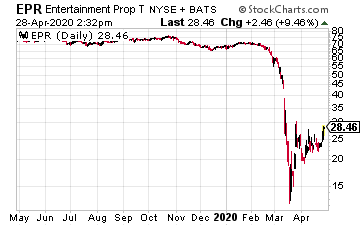

EPR Properties (EPR) is a real estate investment trust (REIT) that owns entertainment-focused properties such as multi-plex movie theaters and Topgolf facilities.

About one-third of the portfolio consists of charter and private schools. Almost all of EPR’s real estate properties have been closed due to the virus outbreak.

A conservative financial outlook allows EPR to continue to pay the monthly dividend, even though it is collecting just 15% of its contracted rent.

EPR management recently stated it could pay the dividend for up to two years at that 15% collection level.

The shares currently yield 19%.

$25k = $28,762 in annual income for life [sponsor]

With one simple strategy, you'll be able to take $25k from your 401(k) or IRA and turn it into tens of thousands of dollars in income every single year. You will only find the strategy FREE when you click here.