The Best Stocks Waging the Battle Against COVID-19

By Eddy Elfenbein, Investors Alley, Saturday, April 4

Across the globe, there’s an intense race to find a vaccine to protect us from COVID-19. There are some promising developments, but it will take time to finally reach a market-ready solution.

I must, however, point out the fighting spirit of Dr. Daniel Reardon.

Dr. Reardon is an astrophysicist, but instead of working out the secrets of the universe, Dr. Reardon has been stuck at home. Boredom led him to brainstorm a device to combat the spread of COVID-19: a necklace that would warn you when you touched your face.

Sounds like a good idea, right?

I’m afraid to say that Dr. Reardon may not find himself among the greats like Newton and Einstein.

The Guardian reported this week that development of his invention didn’t quite go according to plan. Apparently, Dr. Reardon had to go to the hospital because he got four magnets stuck up his nose. The self-isolation, it seems, is driving all of us a little batty.

Cutting the Testing Time Down

There are, however, more robust efforts to combat COVID-19. Last week, I mentioned that Cepheid, a division of Danaher (DHR), developed an on-site COVID-19 test with a 45-minute turnaround, much better than the four days current tests take.

Shares of Abbott Labs (ABT) recently got a nice bump after the company said it won emergency Food and Drug Administration (FDA) authorization for a five-minute COVID-19 test. Abbott Labs hopes to ramp up production so it can administer 50,000 tests per day. This is free enterprise in action.

Johnson & Johnson (JNJ) has said that it’s already working on a potential vaccine, which could be available early next year. Unfortunately, these vaccines require time and money before they can be approved. J&J said it hopes to begin testing in people by September. One of the major concerns is potential side effects.

The FDA has procedures for rapid approval of drugs needed in an emergency. J&J said it if the drug is successful, it would be sold on a not-for-profit basis. The company hopes to expand its capacity to make one billion doses by the end of next year.

Johnson & Johnson isn’t the only one working in a vaccine. Boston area-based Moderna (MRNA) is also working on one, and they’ve already begun human trials. Moderna is using messenger RNA, a less-well-known method for developing vaccines.

Along the same lines, Translate Bio (TBIO) has partnered up with Sanofi (SNY) to find a messenger RNA vaccine.

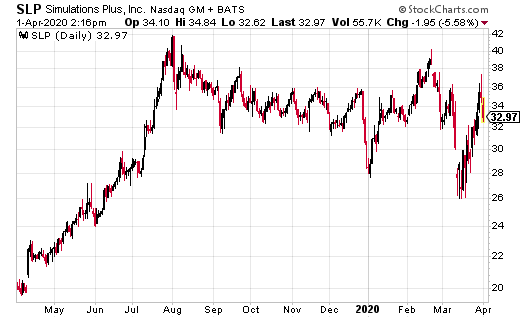

The Best of Breed: Simulations Plus (SLP)

My #1 stock is the race to fight COVID-19 is slightly different. My pick is a classic picks-and-shovel play called Simulations Plus (SLP), which makes software that lets drug companies simulate tests of their products in the virtual world before undergoing human or animal testing. This is a big cost saver for drug companies.

Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles. In fact, there are times when the results from SLP’s tests have allowed companies to waive clinical studies.

This means drug companies don’t have to deal with the time and expense of recruiting test subjects and analyzing test results. The cost savings are substantial. SLP’s software can be a big help for any company racing to find a vaccine.

Last week, the company established its StrategiesPlus COVID-19 ACT Program designed to speed consulting assistance to any organization involved in coronavirus research

By using Simulations Plus’s software, drug companies can experiment with many variables like fine tuning dosage amounts. Companies can also see potential harmful side effects. Another important factor is that companies can identify treatments that aren’t beneficial.

In healthcare, cost control is a major issue. That’s why Simulations Plus’s products are in such heavy demand.

Simulations Plus is also branching out from their core customer base of drug companies. They work with consumer products companies to see the side effect of things like pesticides.

The financial numbers are very impressive. Over the last ten years, Simulations Plus has maintained organic growth of 12% to 14%. Notably, they’ve done this without carrying a penny of debt.

The company is sitting on $12.6 million in cash, which is quite good considering they’ve paid out about $30 million in acquisitions and dividends. I also like that Simulations Plus has an operating margin of more than 35%. That tells me that they have pricing power.

A few months ago, Simulations Plus said that it reached a five-year agreement with the FDA to evaluate alternative approaches for “determining product bioequivalence for locally-acting drugs in animals.”

I love this deal. What it means is that it lets the FDA use SLP’s GastroPlus software to see how effectively drugs work on dogs, without using dogs.

Over the last six years, earnings per share have grown from 18 cents to 25 cents to 29 cents to 33 cents to 42 cents, and last year Simulations Plus made 48 cents per share. I think the company has a good shot of making close to 54 cents per share for this fiscal year. If that happens, that would mean Simulations Plus doubled its profits in four years, and with no debt.

This is a great company and it may play a major role in defeating COVID-19. Its next earnings report is due out in early April.

President Trump's Secret 5G Stock Nod? [sponsor]

President Trump is now officially on the record as saying, “The race to 5G is a race America must win, and it’s a race, frankly, that our great companies are now involved in.”

But here’s what Wall Street and the media won’t tell you... The great companies Trump is referring to are NOT just Verizon, Sprint, or AT&T. New evidence suggests Trump may have been referring to this secret 5G company. It’s not a household name… yet, but experts say it’s ready for “Amazon-like” growth.