Will This 6.34% Yielder Keep Shareholders Entertained?

By Marc Lichtenfeld, Wealthy Retirement, Tuesday, February 18

Many Wealthy Retirement readers have asked for a breakdown of EPR Properties (NYSE: EPR)… and I’m here to deliver.

EPR is a real estate investment trust (REIT) that buys and develops entertainment-related properties. These include movie theaters, ski and golf complexes, and water parks.

The company uses long-term triple-net agreements, in which it buys a property and then leases it back to the original owner.

This structure benefits EPR because it places cost burdens, like property taxes, insurance and maintenance, on the tenants.

Tenants then have an incentive to renovate thanks to the long-term leases.

In fact, the average remaining lease term on EPR properties is 12.5 years, with only 2.9% of rent revenue expiring in the next 10 years.

This leads to a near 99% occupancy rate. And this consistency led to revenues that have risen 40% since 2011.

Annual net profit rose by 70% during the same time frame.

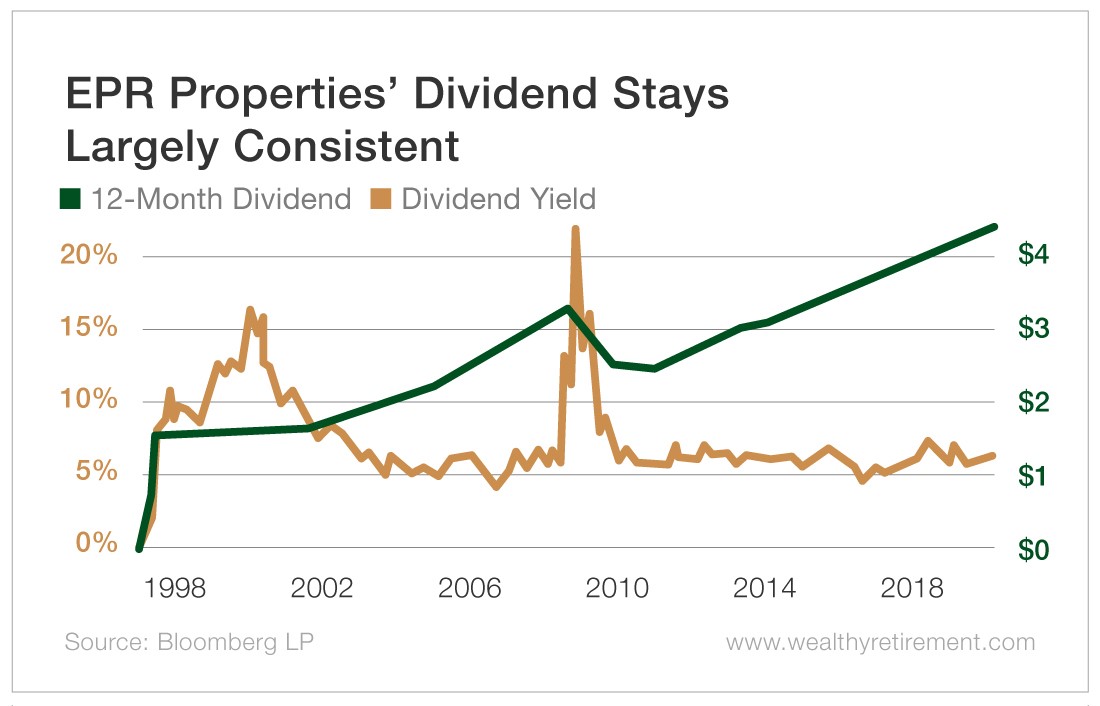

EPR currently has a 6.34% yield, which has stayed above 4.25% since 1998. The monthly dividend is $0.375 per share and has grown 5.53% over the last five years.

Analysts project EPR’s funds from operations, or FFO, to be less than the total amount of dividends paid in 2019. If so, it’ll be the first time since 2011.

(Earnings are announced on February 24, so we will see.)

FFO is used to pay dividends, so it is a key indicator of a dividend’s health.

In our SafetyNet Pro system, EPR’s declining FFO is a negative mark for the company.

So what’s ahead for EPR in 2020?

- Movie theaters account for 45% of EPR’s revenue, mainly through operator AMC Theatres. AMC scored $886.1 million in box office sales last month, up 8.6% from a year ago.

However, this figure is projected to be 1.7% less for the year based on the movie release calendar.

But theater operators are investing more into features like reclining seats, in-movie dining services and full-service bars.

These innovations help combat the consumer shift to streaming services, protecting AMC.

- Golf tenants account for 10.2% of EPR’s “Eat & Play” revenue. Most of that revenue is generated by the company Topgolf.

Topgolf combines an interactive driving range with food and drinks.The company has grown from 10 complexes in 2013 to 47 today. Sales revenues have grown from $163.5 million in 2014 to more than $300 million annually.

Topgolf is also being used as a business setting because it’s preferable to spending an entire day playing 18 holes.As a Topgolf customer, I am very bullish on the company. I’m from Chicago, so escaping terrible winters with year-round golf cured some seasonal blues.

- Experiential consumer spending is becoming more and more important, especially as millennials wield more spending power.

Millennials are increasingly more concerned with the totality of their experience (rather than with simple material items) and spend with a plan to share these experiences on social media.

These consumer habits are vital to EPR’s business model. Therefore, discretionary spending is a key indicator of future returns.

Consumer spending accounted for nearly 70% of U.S. economic output in the third quarter of 2019 and grew 2.4% in November. This rate has grown for 11 straight years.

Historically low unemployment has been buoyed by the Fed’s decision to keep rates low. This decreased borrowing costs and improved financial health.

Therefore, if the Federal Reserve decides to raise rates, it will hurt EPR’s outlook.

The company’s leases include protections to shield against moves in interest rates, but at the end of the day, REITs rely on borrowing.

A Promising Outlook for 2020

For its dividend to remain safe, EPR also has to overcome a projected decrease in FFO (a measure of cash flow) in 2019.

A dividend cut in 2013 also isn’t helping its case.

Negative macroeconomic data reports will also impact EPR’s share price and put its dividend at risk.

But EPR depends on the American consumer, who has never been stronger. Spending has continued to rise along with wages.

For the near future, the dividend seems to be safe. EPR has a nearly perfect occupancy rate with quality tenants. Its FFO is expected to be less than desirable for 2019, but it should rebound.

The company should continue to offer a more than 5% return.

Dividend Safety Rating: C

The highest dividend ever? (I'm in SHOCK) [sponsor]

Sorry to bother you, but you've got to see this.

I've been working for months on a secret income project, and I just hit a breakthrough.

I may have just discovered the single highest dividend yields of all time.

I'm talking dividends that grew to return more than 100%... 200%... and even 500% of the initial investment.

In fact, one of them... for a relatively unknown firm called Novation Companies... grew to a ridiculous 1,406%.

Let me be clear...

A 1,406% yield means that an original investment of $5,000 pays you back $75,340 every year... for life.

Yields like that are the holy grail of income investing.

And today, I'm revealing my findings for all to see.

Check out my presentation on what I’m calling "Extreme Dividends."