An Upgrade for a 12% Yielder

By Marc Lichtenfeld, Wealthy Retirement, Tuesday, January 21

New Residential Investment Corp. (NYSE: NRZ) is one of the most requested stocks in the Safety Net column.

That’s not too surprising considering the stock pays a 12.1% dividend yield and has never cut the payout. In fact, it has raised the dividend five times since it began paying one in 2013.

The $0.50 per share quarterly dividend has remained the same since June 2017.

New Residential Investment is a mortgage REIT. It borrows money short term and lends it out long term at higher interest rates.

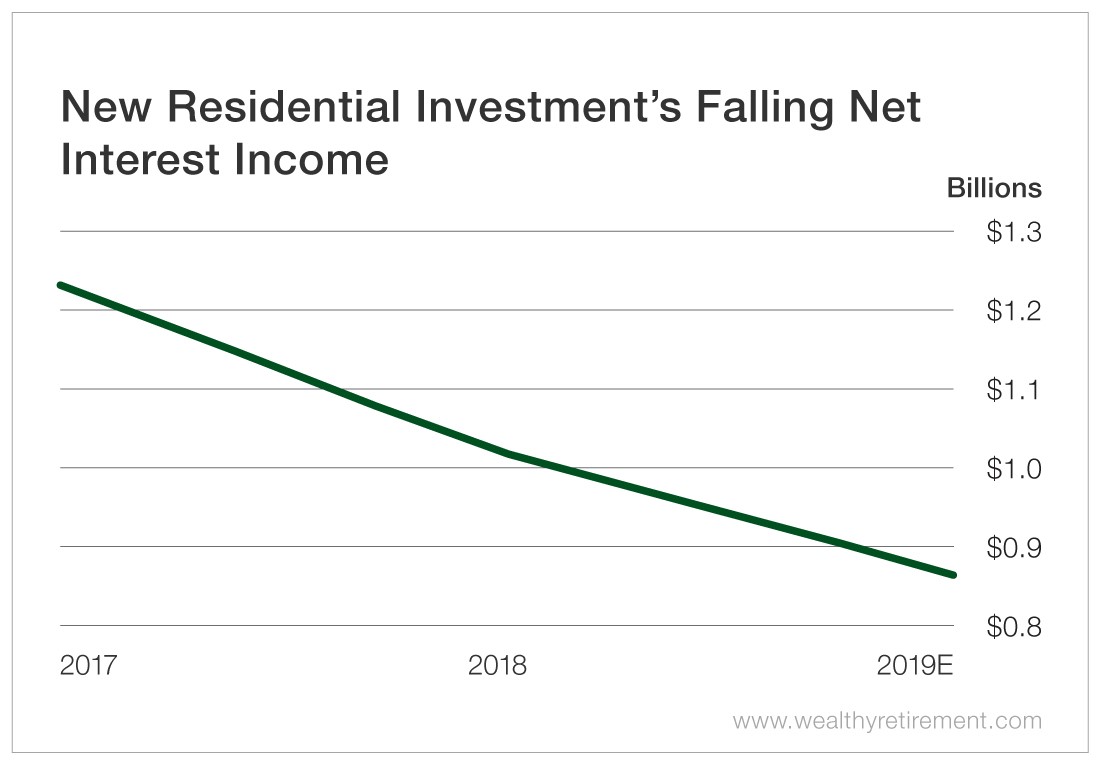

When I covered the company in this column in May, the dividend safety rating was lowered because of falling net interest income (NII), which is the difference between how much it costs a REIT to borrow capital and how much it makes lending it.

This was the chart from May’s column.

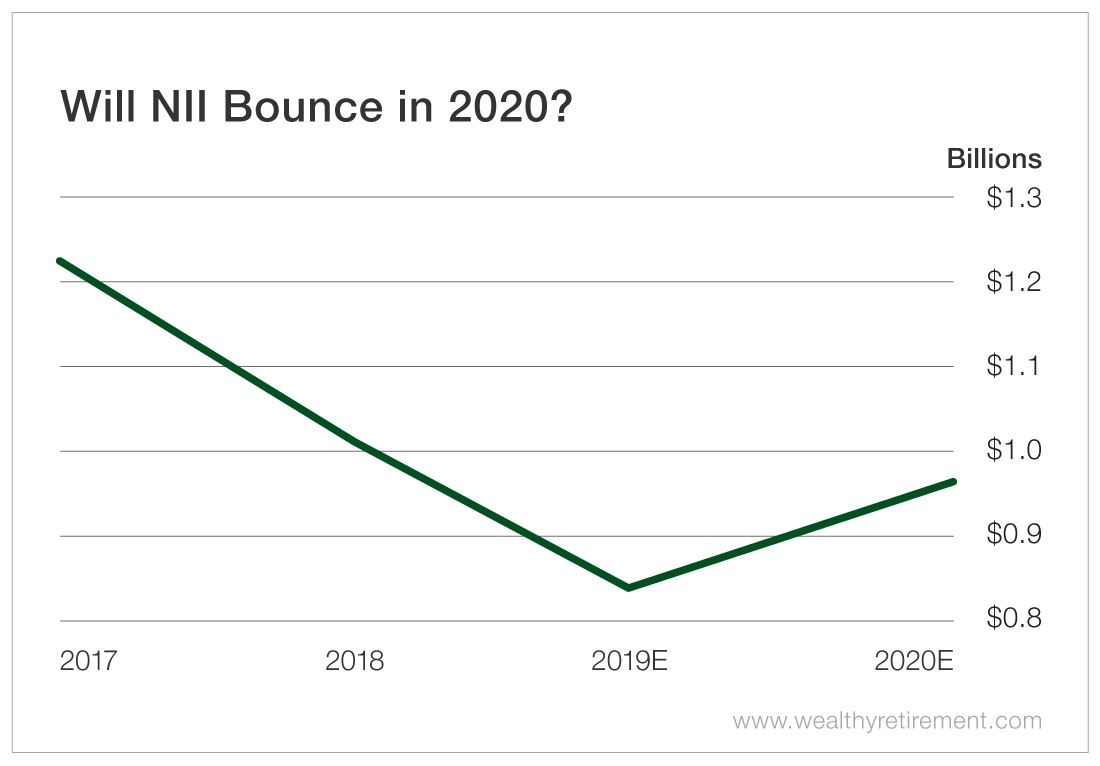

The numbers for 2019 aren’t in yet, but expectations aren’t fantastic. When I wrote the article, NII was expected to be $867 million for the year. That estimate has slipped to $839 million.

But in the world of dividend safety, “What have you done for me lately?” isn’t our main question. We think in terms of “What will you do for me in the future?”

In 2020, analysts predict NII will rebound a bit to $962 million. That’s still below 2018’s total, but it’s an uptick from 2019.

While the company’s NII is forecast to be $839 million, it is expected to have paid out $830 million in dividends. If NII doesn’t cover the dividend, the stock will receive a downgrade from SafetyNet Pro.

When the company releases its results in mid-February, we’ll see if it was able to afford its dividend in 2019.

If NII is more than the dividend paid and it bounces in 2020 as expected, that will give investors more breathing room and assure them that the dividend is safe.

The key to this scenario is that NII does in fact improve in 2020. If it doesn’t, we’re likely looking at a lower rating than we have right now.

But as of today, with NII (barely) covering the dividend, an expected increase in NII and a short but solid dividend-paying track record, the dividend appears fairly safe in the near term.

Dividend Safety Rating: B

Dividends that Could Pay 100% Yields [sponsor]

Do the math, and a dividend with a yield of 100% would take your initial investment of $1,000, and pay you $1,000 every single year, for life. The good news is, these dividends do exist…

I call them “Extreme Dividends,” and I’ve found three that you should take a look at. All of them have the potential to pay out 100% or more of the initial investment in yields over time.

As you’re about to discover, this is truly the income secret you never knew existed.

It’s even possible to nail a 1,099% yield payout on one of these “holy grails” of dividends.

But see it all for yourself, I’ve put together my findings in a free presentation…