Will December 2019 Be a Repeat of December 2018 For Stocks?

By Jay Soloff, Investors Alley, Tuesday, December 10

The stock market is showing its first signs of cracks since October, and investors are starting to wonder if December is going to be a repeat of last year. As a reminder, the S&P 500 was down about 9% a year ago in December after what had been a volatile fourth quarter.

Of course, this year, the fourth quarter has mostly been as flat as a pancake in terms of volatility. It was beginning to look a lot like 2017 from a volatility perspective, one of the least volatile years in recorded history.

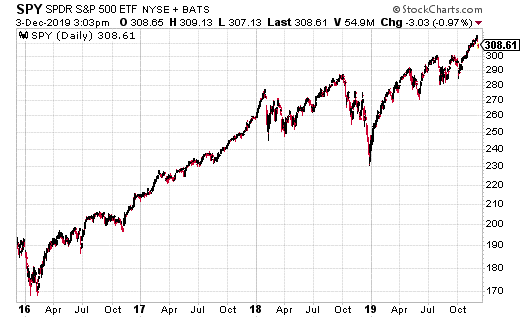

Looking at the 4-year chart of SPDR S&P 500 ETF (SPY), the most heavily traded ETF on the market, you can see what I was just referring to. In 2017, the market was extremely calm, going up in a very measured fashion. Over the past year, you can see that while the market has continued moving higher, there’s been a lot more whipsawing along the way.

(By the way, if you ever hear the term “path-dependent” associated with stock/options/volatility, this is what it means… You may be able to compare a start and endpoint between two periods, like 2017 and 2019, and show similar results. However, the path taken in each year to get to those endpoints will be very, very different.)

Whether or not December is going to be like 2018 remains to be seen. Given the last several weeks, it seems more likely that the markets will calm down sooner rather than later. So, what does that mean for 2020? If December ends up being a relatively quiet month (or even if it doesn’t), is 2020 shaping up to be another good year for stocks?

I think it’s pretty obvious that the 2020 election is going to have a huge impact on the financial markets. But that’s not until late in the year. What about the first quarter of 2020? Have there been any clues as to what to expect?

One well-capitalized trader believes the first quarter of 2020 will be at least moderately positive for stocks. This trader placed a large covered call bet on SPY, with options expiring in March.

More specifically, with SPY at $30; 300,000 shares were purchased versus 3,000 March 317 calls sold for $5.65. Let’s break this down. The trader collects $1.7 million from the call sale, which works out to a yield of just under 2% in about 15 weeks. By selling the 317 calls, there’s $8 in upside potential that can be gained from the stock or around 2.5% upside potential.

If the position reaches max gain (with SPY at $317 or above at March expiration), a total of around 4.5% gains can be generated. That’s not bad for under 4-months, but not very aggressive either in terms of upside potential.

Meanwhile, this trade has defensive value in that the $5.65 collected means the position doesn’t lose money until SPY is below $303.35. In other words, the short call helps provide around a 2% cushion on the long shares of SPY. Once again, this is a fairly conservative covered call trade.

A trade like this suggests a fairly neutral view on the market, in my opinion. The trader is neither expecting a massive selloff nor a huge rally. As such, if you are moderately bullish on stocks next quarter, this is a solid trade. It provides some upside potential but also some downside protection.

$500 into $678,906? [sponsor]

If you had followed Jay Soloff’s 2018 trades, with a little luck, you could’ve turned $500 into as much as $678,906. That sounds unbelievable. But you gotta see how it’s possible.

If you can scrounge together $500 in cash, it could’ve been worth a small fortune today. Check out how it could’ve happened for you, click here.