Should You Bet Big on the Latest Red-Hot IPO?

By Nicholas Vardy, Liberty Through Wealth, Thursday, November 21

- IPO is a phrase that conjures magical ideas of untold wealth for investors. But are these red-hot opportunities actually a good investment strategy?

- Today, Nicholas Vardy explains how investors can safely profit from the latest IPOs.

For many investors, IPO – initial public offering – is a magical phrase.

As a reminder, an IPO happens when a company first lists on a stock exchange and investors can buy its stock in their brokerage accounts.

I was in New York City when Facebook (Nasdaq: FB) IPO’d on May 18, 2012. The electronic screens in Times Square were awash with Facebook logos. CNBC covered the event with breathless enthusiasm, monitoring every tick of the stock.

Had you invested in Facebook that day at $38 a share – and held on even when it dropped to $18 – you’d be a happy camper today.

Yesterday, Facebook closed at around $193. That works out to an average annual return of about 26% per year.

IPO Market: The Dot-Com Boom vs. Today

The heyday of IPOs in the U.S. stock market was, of course, the dot-com boom of the 1990s.

Silicon Valley IPOs minted millionaires at a furious pace as share prices soared on the first day of trading.

In 1998, eBay (Nasdaq: EBAY) listed at $18 a share. By the end of the first day of trading, it had leapt to $53.

By 1999, the market was even hotter. Priceline, now Booking Holdings (Nasdaq: BKNG), also listed at $18. By the close of business that day, shares traded hands at $82.50.

Alas, today’s IPO landscape is very different. That’s because most high-profile IPOs have been duds.

Whether it’s Blue Apron (NYSE: APRN), Uber (NYSE: UBER), Snap (NYSE: SNAP) or Lyft (Nasdaq: LYFT)… Each of these companies’ shares are trading below their IPO price.

Take the example of ride-hailing giant Uber.

Its share price recently tumbled to its lowest point yet: $25.58. That’s versus its IPO price of $45. (Uber founder Travis Kalanick dumping $540 million worth of Uber shares in the market didn’t help.)

So the question arises… Should you even bother investing in an IPO?

Recently, Verdad – a Seattle-based hedge fund firm – examined just that topic.

And its conclusion was clear as day.

Despite the success you may have had with Facebook… Steer clear of shiny new IPOs. They could end up costing you a lot of money.

Let me explain…

The Lure of a Sexy IPO

A well-pitched IPO sucks an investor in. You get to invest in a compelling, exciting growth story… and you have the prospect of getting rich in the process.

(A friend of mine always joked that every new bouncing baby could grow up to be president. Alas, by the time they hit the age of 14, it is far more likely that they just turned into another pimply, obstreperous teenager.)

Verdad ran the numbers for 3,700 IPOs dating back to the late 1980s.

The median lost 31% of its value from the date of the IPO to the closing price on the same date three years later. Hold on for five years, and the average loss grows to 41%.

The longer-term returns are even worse.

Had you bought and held on to each of the IPOs, you’d have lost about half your wealth 50% of the time… and 75% of your wealth a quarter of the time.

Ouch.

That’s a long way from cranking out 26% average returns by investing in Facebook… or quadrupling your money on the first day in Priceline.

Put another way, investing in the bouncing baby boys of the investment world may be the easiest way to lose nearly all your money.

How to Best Invest in IPOs

At first blush, Verdad’s conclusions suggest that you should never invest in IPOs.

But there is another way…

You can apply a disciplined strategy to investing in IPOs through an ETF.

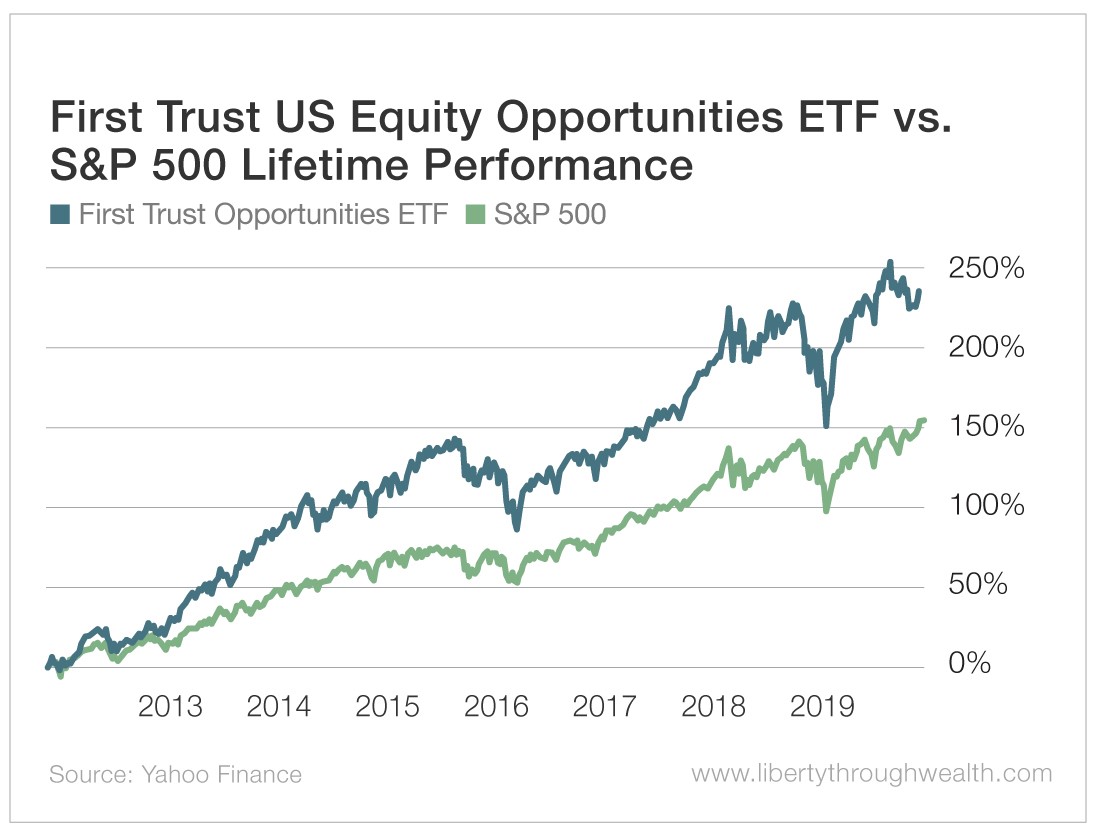

The First Trust US Equity Opportunities ETF (NYSE: FPX) tracks a market cap-weighted index of the 100 largest U.S. IPOs over the first 1,000 trading days for each stock.

The First Trust Opportunities ETF invests in eligible stocks after the close on the sixth trading day and sells them on the 1,000th day. That makes its average holding period roughly four years.

Here’s the critical part…

The ETF does not invest in all IPO stocks. Instead, it applies quantitative screens to each potential investment. It also imposes minimum size and liquidity requirements.

This selection process has ensured that the First Trust Opportunities ETF has minimal, if any, exposure to the recent IPO duds mentioned above.

As the chart below confirms, the strategy has substantially outperformed the S&P 500 over its lifetime.

So should you invest in individual IPOs? Well, the odds are against you.

But invest in a disciplined strategy that identifies the right IPOs… And consistent, market-beating returns could be yours.

WARNING! Move Your Money ASAP [sponsor]

This decision is coming out of Washington shortly... and it could change the way we invest forever.

If you have any money invested at all... even just in a retirement account... you've got to see what's happening.

But you need to hurry. The big announcement is just days away.