Is It Time To Start Buying Options Instead of Selling Them?

By Jay Soloff, Investors Alley, Tuesday, October 8

In a world of ultra-low interest rates, it seems every investor is searching for yield. Of course, that should come as no surprise when 10-year notes are yielding something like 1.6%. A yield like that is certainly not going to fund most people’s retirement!

Given the yield of government bonds, it’s also no wonder that assets like high-yield bonds and dividend stocks have taken off in recent years in terms of cash inflows. If investors can’t get the yield they seek in Treasuries, they will turn to other investment vehicles.

And that’s where options come in…

Investors have always been able to use options strategies to generate income. However, recently, income-generating strategies have exploded in popularity. Well-known strategies such as covered calls and cash-secured puts have received billions in cash inflows over the last few years.

Even pension funds have started using these overwriting strategies, as they are commonly called. It’s a way to generate yield while meeting certain risk parameters inherent in those sorts of funds. In other words, pension funds care about risk-adjusted returns far more than ordinary returns. Using options for overwriting can certainly help “smooth out” returns over time.

Getting back to overwriting, the one thing all overwriting strategies have in common is that they will be a net seller of options, used to generate income. That means you need to sell more options than you buy if you want to earn a credit on the trade.

Whatever you may have heard about selling options, it can be done quite safely using proper risk management techniques. For example, a covered call strategy is generally safer to use than a simple buy and hold strategy – otherwise, you wouldn’t see pension funds pouring money into it.

In a nutshell, options tend to be “overpriced” relative to their fair value because investors use them as protection (insurance). Selling options takes advantage of this overpricing by allowing the seller to become the insurance company.

Here’s the thing…

The problem with the skyrocketing popularity of selling options for income is that is has become a very crowded trade. That is, so many people/funds are doing it that is has depressed the price of options in many of the most popular products.

As options become cheaper because of the huge demand from options sellers, it becomes less and less profitable to do those types of trades. What’s more, as profitability goes down, it results in risk going up. There is less cushion in your portfolio (to absorb losses) as margins become razor-thin.

So if selling options has become a crowded strategy, does that mean that it’s time to start buying options? To some extent, the answer is yes.

Keep in mind; buying options can be a challenging way to make money because of time decay. Options you own will slowly (or quickly in some cases) lose money as you get closer to expiration. That means you have to be extra careful before going out and loading up on long options.

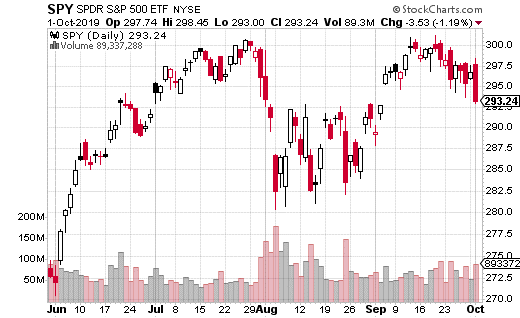

That being said, there are definitely quite a bit more opportunities to buy options now than there has been in years. For instance, buying cheap insurance on SPDR S&P 500 ETF (SPY) may make a lot of sense right now.

To put it into some perspective, the cost of a 1-month at-the-money put in SPY is sitting right about at its 52-week average. Considering how much potential volatility could hit the market with all the headline risk (political and economic both), it could be a very reasonable time to hedge your portfolio by purchasing SPY puts.

$500 into $678,906? [sponsor]

If you had followed Jay Soloff’s 2018 trades, with a little luck, you could’ve turned $500 into as much as $678,906. That sounds unbelievable. But you gotta see how it’s possible.

If you can scrounge together $500 in cash, it could’ve been worth a small fortune today. Check out how it could’ve happened for you, click here.