The Home Run Stocks Wall Street Doesn't Want You To Know About

By Eddy Elfenbein, Investors Alley, Sunday, September 22

Imagine there’s a stock that’s up nearly 30-fold since 2000 and not a single Wall Street investment analyst follows it.

This investment has crushed just about every hedge fund out there, yet Wall Street is entirely unaware of it.

Worst of all, it’s stock in a company that’s known by many. It’s a favorite of people who work on Wall Street.

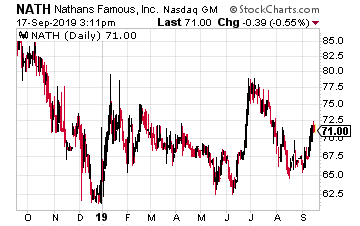

The stock I’m talking about is Nathan’s Famous (NATH).

That’s right, the hotdog place. It’s a New York institution. Not only that, it’s a July 4th institution. They sponsor the annual July 4th hotdog-eating contest. When you have a moment check out the ESPN video of this year’s contest featuring record holder Joey Chestnut.

Nathan’s is currently in its 102nd year of business. The hotdog stand was started by a guy named, wait for it, Nathan. In this case, Nathan Handwerker.

Today, there are tons of Nathan’s located across the country, and several locations around the world. (Earlier this year, I was at the location near Manila in the Philippines.)

I bet you didn’t know Nathan’s has also been an astounding winner.

In late 2000, shares of Nathan’s were going for $2.50 apiece. Lately, Nathan’s is going for $70 each. (That’s down from its high of $107.)

Nathan’s is what we call an “Orphan Stock.” That means that it has zero or near-zero analyst coverage.

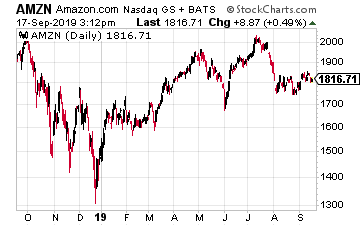

I love Orphan Stocks. They’re a great place to find overlooked values. Consider a stock like Amazon (AMZN). I love Amazon, and I wish I had bought it years ago, but what new information can I find on the company now?

Amazon is already worth $900 billion. There are 50 firms in Wall Street that follow the stock. The stock basically lives in a glass fishbowl. That’s not the case with Nathan’s which, despite its name, apparently isn’t as famous as I thought.

How can a stock rise so much for so long and no one on Wall Street has ever thought to start covering it? Part of the reason is probably because they don’t bring Wall Street any investment banking business.

That’s more of a plus than a minus. It suggests the company hasn’t entered into any unwise mergers. Or taken on too much debt. Or has been acquired at a poor price. Not needing a banker is hardly a bad thing.

Every earnings season, investors gather to see what companies have beaten expectations and what companies have fallen short. It’s interesting because a company can have a lousy quarter, but as long as it was less lousy than expected, then it can be a good quarter for its stock. Investors are expecting expectations.(awkward sentence) maybe; investors are expecting the stock to meet expectations.

With Nathan’s and other Orphan Stocks, there’s nothing to expect. Why? Because no one follows them. For an investor, that’s another bonus. They don’t have to worry about the Wall Street earnings game.

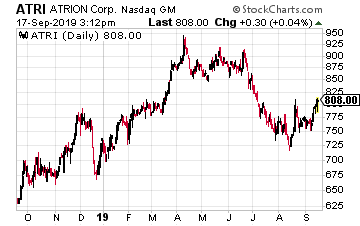

Have you ever heard of Atrion (ATRI)? Don’t worry. You’re not alone.

Atrion is a medical products company based in Dallas. Even though they’re small ($1.5 billion market cap), they’re active in some very niche markets like soft contact lens disinfection cases. Ever wonder who makes valves for life vests? There’s a good chance it’s Atrion. I particularly like that Atrion has wide operating margins.

Thirty years ago, you could have picked up one share of ATRI for $6. Recently, the stock got up to $927 per share. A few weeks ago, Atrion boosted its dividend by 15%.

Now I’m going to ask you a straightforward question: Guess how many firms on Wall Street cover Atrion? I’ll give you a hint. It’s the same as Nathan’s.

That’s right. Zero.

Let’s also remember how hard the financial crises blew through Wall Street. The big houses simply don’t have the big research departments that they used to. The budgets have been cut back. As a result, there are lots of companies that get no analyst coverage.

Many Orphan Stocks have been orphaned for good reasons; they’re not very good. But if you look closely, there are many incredible orphan stocks like Nathan’s Famous and Atrion.

With fewer eyes watching, it’s easier to find overlooked gems. Make sure there are some Orphan Stocks in your portfolio.

Buffett just went all-in on THIS new asset. Will you? [sponsor]

Buffett could see this new asset run 2,524% before the end of 2019. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen... And if you act fast, you could earn as much as 2,524% before the year is up.