Finding the Right Balance With Trading Frequency

By Mable Buchanan, Wealthy Retirement, Thursday, September 19

One of the most common questions our strategists receive is “How often should I be trading?”

There’s no one correct answer to this question. Deciding how often to trade should take your personal preferences, risk tolerance and investing goals into account.

Often, your comfort level with your current investing habits can provide insight as well.

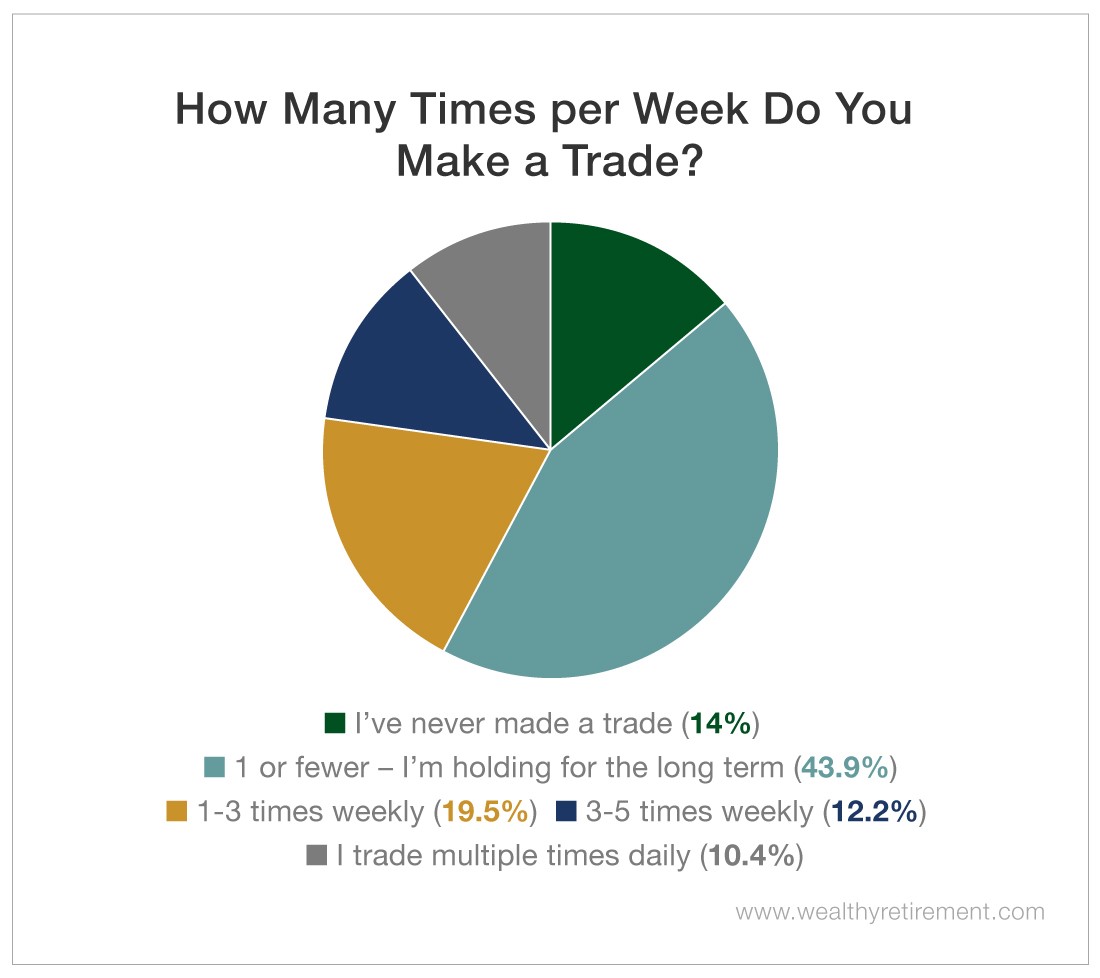

That’s why this week, we asked Wealthy Retirement readers how often they make a trade per week.

About 44% of our readers indicated that they trade only up to one time per week. These investors stick to a long-term buy-and-hold strategy.

This can be a dependable route to a wealthy retirement. Chief Income Strategist Marc Lichtenfeld often talks about the value of investing in Perpetual Dividend Raisers and holding them for years.

In fact, we’ve mentioned several Perpetual Dividend Raisers in Wealthy Retirement. (For example, we’ve analyzed AT&T (NYSE: T) and Chevron (NYSE: CVX).)

The magic of these stocks lies in dividend reinvestment.

AT&T, for instance, has a 10-year dividend growth rate of 2.2%. Currently, it sports a 5.43% yield.

Using Wealthy Retirement’s Dividend Reinvestment Calculator, if you bought 30 shares of AT&T for $113.94 and held them for 25 years, you’d finish with $4,141.51.

(For help getting started investing in Dividend Aristocrats, check out Wealthy Retirement’s list of “The 10 Best Dividend Aristocrat Stocks.”)

However, these aren’t the only wealth-building tools in an investor’s toolbox…

Secrets From Investors With Higher Trading Frequency

Almost one-fifth of our readers reported that they trade one to three times per week.

The remaining 22.6% trade three times per week or more. One-tenth of our readers trade multiple times daily.

For higher-frequency traders, using “smart speculation” to take on calculated risk can be rewarding…

Take a former Dividend Aristocrat, Bank of America (NYSE: BAC), for example.

During last winter’s market turbulence, Karim encouraged his readers to make a bullish options trade on the company.

The stock moved 5% in response to positive earnings news. The option moved 40%.

Recently, options expert Bryan Bottarelli recommended that his readers make a play on Microsoft (Nasdaq: MSFT) on its earnings release date.

Those readers scored as much as $4,100 on a single trade.

Many investors are hesitant to trade options because they are uncomfortable taking on risk.

The most important consideration when choosing your investing style is whether you’ll be able to sleep at night.

In fact, for most investors, the most comfortable strategy involves striking a balance between buy-and-hold investing and options trading.

That’s why we advocate for a combination of long-term holds and short-term trades here at Wealthy Retirement. It’s all about getting the most out of your money while remaining comfortable and confident.

With that in mind, be sure to put only money you’re comfortable losing at risk and keep funds you will need for expenses in the next three years somewhere safe.

Then, trust the experts to know which trades have the most potential, and trust your gut to know whether you’re comfortable or need to adjust your trading frequency.

You don’t have to act on every profit opportunity you see, but there are enough to satisfy any investor. You can have your pick of the bunch.

WARNING! Move Your Money ASAP [sponsor]

This decision is coming out of Washington shortly... and it could change the way we invest forever.

If you have any money invested at all... even just in a retirement account... you've got to see what's happening.

But you need to hurry. The big announcement is just days away.