A Big Bet That Gold Prices Are On The Move This Summer

By Jay Soloff, Investors Alley, Monday, July 15

With all the talk of interest rates, inflation, and recessions, it’s no surprise that gold has become a popular topic in the financial media. Gold tends to gain popularity among investors when there is uncertainty regarding the economy.

More specifically, when there is concern the US dollar is going to become less valuable, gold starts to attract more buyers. Other variables have the potential to move gold prices higher, such as lower interest rates and higher inflation. However, it ultimately boils down to if and how those variables will impact the value of the dollar versus other currencies.

Of course, gold has always been a safe-haven investment vehicle in times of uncertainly. Because precious metals have been, well… precious, for thousands of years, they still attract investors as a store of value. This seems to be the case regardless of what new investments have appeared over the years meant to attract risk-averse investors.

I’m personally not a big fan of owning gold. I don’t like long-term investments, no matter how safe, that don’t provide income. But that doesn’t change the fact that gold is still an important asset to track and understand as an investor, akin to following Treasury bond yields for example. (At least Treasury securities pay coupons, albeit at very low rates.)

Here’s the thing…

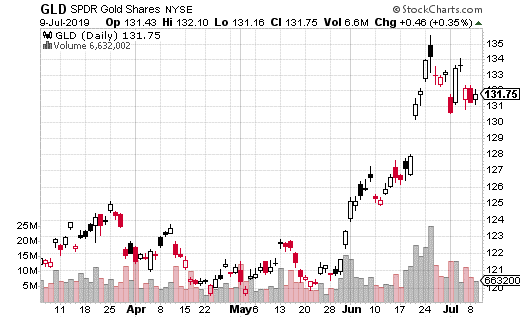

Between the concerns over a looming recession in the US, the trade war with China, and what the Fed will do with interest rates, there has been enough powder in the keg to spark a rise in gold prices. Since a low of around $1,200 an ounce last October, the price of gold has climbed to over $1,400 an ounce. It hasn’t been this high since 2013.

Along with the increase in the price of gold, gold volatility has also been on the rise. It seems that investors aren’t quite sure if the recent spike in price is going to hold up.

In fact, one trader is spending a decent amount of cash to bet that gold is going to move a lot by the end of September… without picking a particular direction. This trade is making that bet by purchasing an options strangle in SPDR Gold Trust ETF (GLD).

An options strangle is simply the buying (or selling) of both a call and a put in an underlying asset which expire at the same time but at different strike prices. This means the trade can make money if the underlying moves enough in one direction or the other. By purchasing different strikes (as opposed to the same strike, like a straddle), the underlying has to move more to hit breakeven, but the trade costs less.

In this case, the trader bought the GLD September 20th 133 put and 135 call, with the stock around $132. The trade costs $5.25, or $525 per strangle. It was executed about 600 times which means $300,000 spent in premium. The premium paid is also the max loss on the trade.

For the trade to breakeven, GLD would need to go to $127.75 or $140.25. From there, there’s basically the chance for unlimited gains. We’re essentially talking about needing a 3% move in either direction to break even on the trade.

$525 is a lot to spend on a strangle, even one that has about 10 weeks to go until expiration. But, a 3% move isn’t all that much of a move given the volatility in the markets (including results from two Fed meetings during that stretch).

The strangle buyer is also leaning to the downside for this trade. Keep in mind, the 133 put is already in the money (GLD was at $132 at the time of the purchase). So, this actually could be more of a bearish play on gold, with the long call portion of the strangle serving as something of a hedge.

Either way, I don’t think this trade is unreasonable. However, it is a lot to pay for a strangle in absolute terms. It may make sense to pick a direction or do a shorter-term trade to save some money on premium costs. Of course, it very much depends on what you believe is going to happen with gold in the coming months.

$500 into $678,906? [sponsor]

If you had followed Jay Soloff’s 2018 trades, with a little luck, you could’ve turned $500 into as much as $678,906. That sounds unbelievable. But you gotta see how it’s possible.

If you can scrounge together $500 in cash, it could’ve been worth a small fortune today. Check out how it could’ve happened for you, click here.