Is This Often-Overlooked Gold Sector About To Take Off?

By Jay Soloff, Investors Alley, Tuesday, June 18

Do you remember what happened to the price of gold in 2011? It was a banner year for commodities as the US Dollar was down and demand from China was soaring. But perhaps no commodity had a more memorable run that year than gold.

If you remember, central banks around the world were buying gold by the boatload. And the global financial crisis very much sparked fears of holding fiat currencies. Physical assets became highly sought after. On many street corners you could find shops buying gold and silver in any form they could get their hands on.

That was the year the price of gold hit nearly $2,000 per ounce. The funny thing is, gold has mostly remained elevated since then even though the price has dropped quite a bit (not adjusted for inflation).

Since 2013, gold has swung between roughly $1,100 and $1,400 with the median price somewhere around $1,200. But perspective is important, and as recently as 2004, the precious metal was only $400 an ounce! It’s back up to about $1,350 these days with the USD once again potentially heading south.

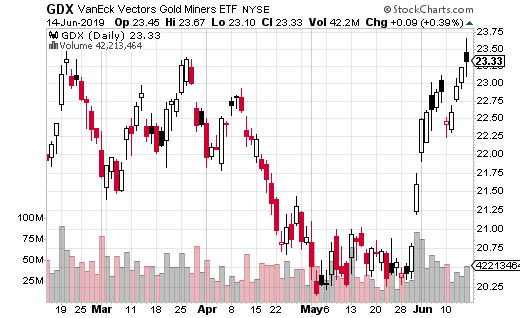

Gold investors will buy everything from physical gold (like gold coins) to gold ETFs to gold mining companies. Looking at gold miners, their fortunes are clearly tied into the price of gold. For example, VanEck Vectors Gold Miners ETF (GDX) is down from the $60 level in 2012 to about $23.

But it’s been an even tougher road for junior gold miners. These companies are generally more about prospecting and less about maintaining cash flows. In other words, they’re riskier… and it shows.

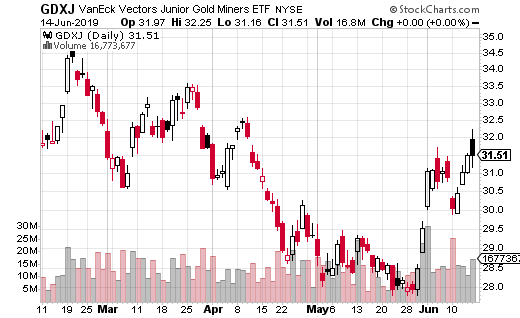

VanEck Vectors Junior Gold Miners ETF (GDXJ) was trading at around $160 in gold’s heyday (2011-2012). Now it’s trading about $32. From a percentage standpoint, junior miners got hammered at far bigger clip than established miners.

Of course, this makes sense. If the price of gold is falling, why take a chance on companies which are risky bets to begin with? Investors are far more likely to take risks with gold trading at $1,800 an ounce.

So are junior miners going to make a comeback now that the price of gold has been climbing? Let’s take a look at the options market for some clues.

Regarding GDXJ, options order sentiment has definitely been positive over the last month. On average, 77% of the options contracts which have traded every day over the last 30 days have been bullish. That’s about as lopsided as you’ll see as far as a 30-day average.

In addition, I recently came across a pretty sizable bullish trade on GDXJ options. With the share price at $32.16, a bullish trader grabbed 1,200 November 35-strike calls for $1.61. That’s a $193,000 bet that GDXJ will be above $36.61 by November expiration.

First off, that one block makes up about 10% of the average daily options volume for GDXJ. Relatively speaking, it’s a huge trade for this stock. Second, even though expiration isn’t until November (5 months away), the position doesn’t even break even until GDXJ climbs 14% higher.

In other words, this is a very bullish trade on junior gold miners. And, it likely suggests that gold is going to keep climbing in the coming weeks and months.

Finally, this is an easy trade to make in your own account if you are bullish on gold in the second half of this year. You only risk the money you spend on the calls, but you have unlimited upside potential should gold and junior gold miners take off.

$500 into $678,906? [sponsor]

If you had followed Jay Soloff’s 2018 trades, with a little luck, you could’ve turned $500 into as much as $678,906. That sounds unbelievable. But you gotta see how it’s possible.

If you can scrounge together $500 in cash, it could’ve been worth a small fortune today. Check out how it could’ve happened for you, click here.